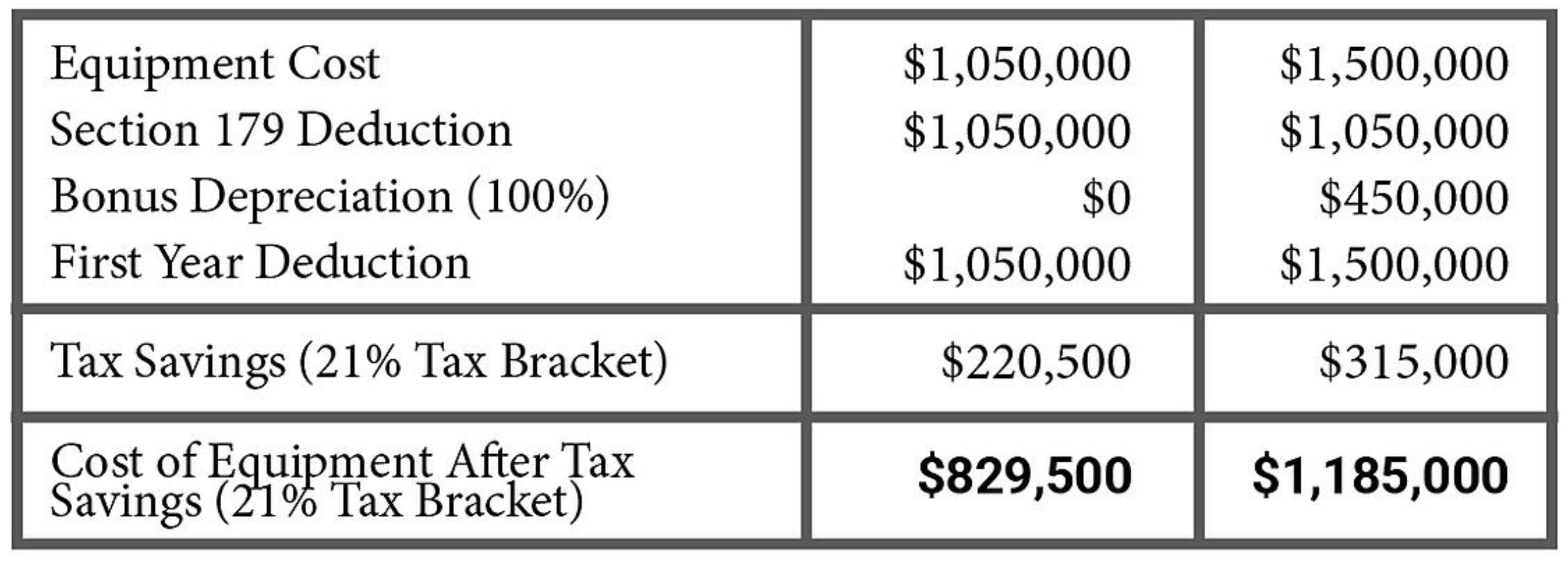

Bonus depreciation calculation example

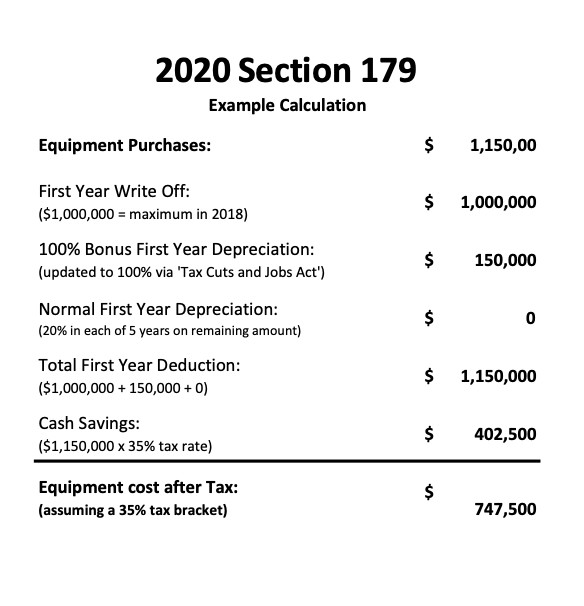

The salvage value is assumed at zero. Equipment Purchase Price 2100000.

Bonus Depreciation And The Macrs Youtube

The basic pay is usually 40 of gross income or 50 of an individuals CTC.

. In 2019 the IRS issued a safe harbor ruling for vehicles. You also have to know a lot of acronyms. For tax year 2018 a taxpayer has a trade or business that generated 2000000 of gross income.

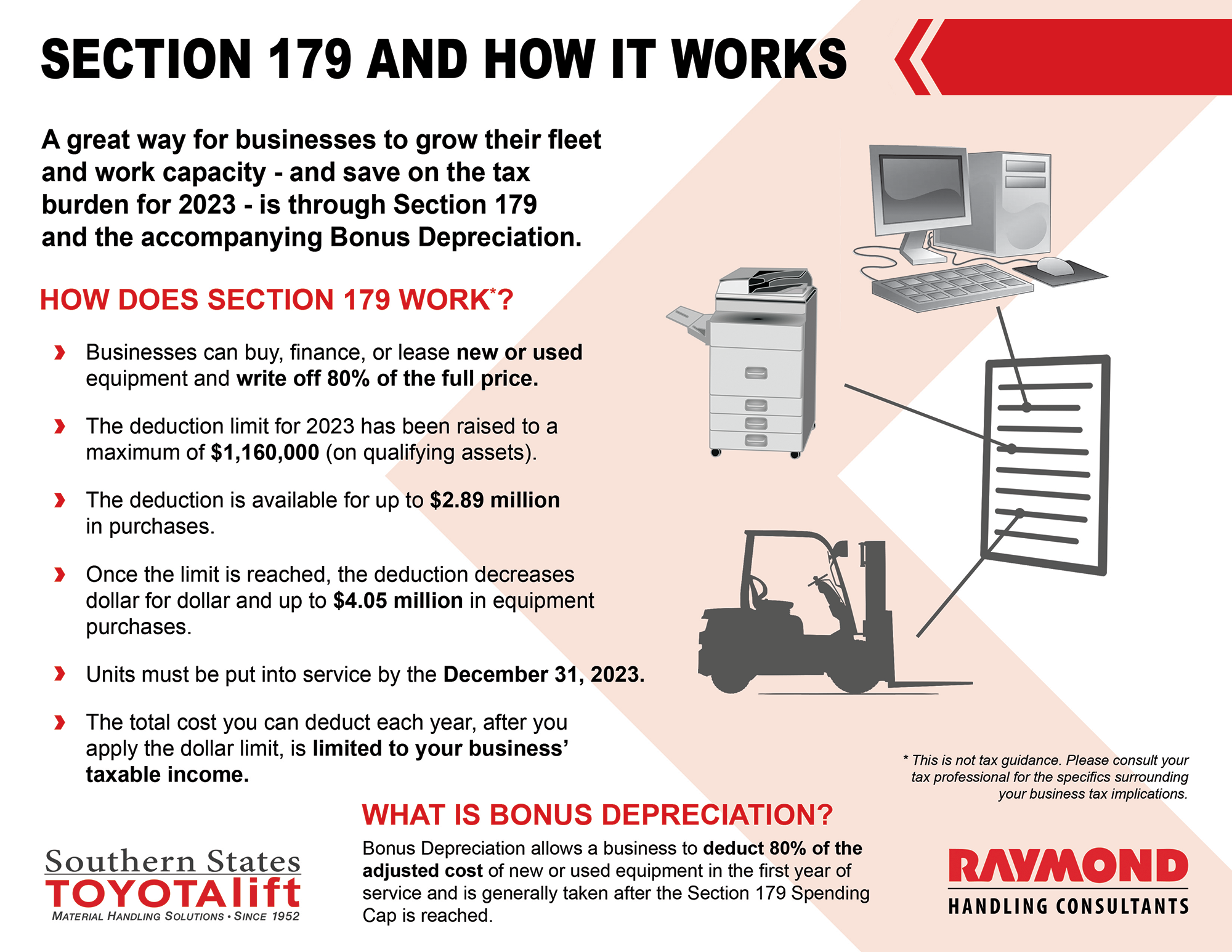

Not all finance agreements can take advantage of Section 179 tax incentives. There are other ways of finding the basic pay. Bonus depreciation applies to new equipment only.

To estimate the calculation of the production cost of packages conditional indicators of OS depreciation percentages of additional wages and taxes mandatory insurance premiums are taken. If we refer to other tables then we use the resulting sums. 1 Tax calculation is only an example for illustrative purposes.

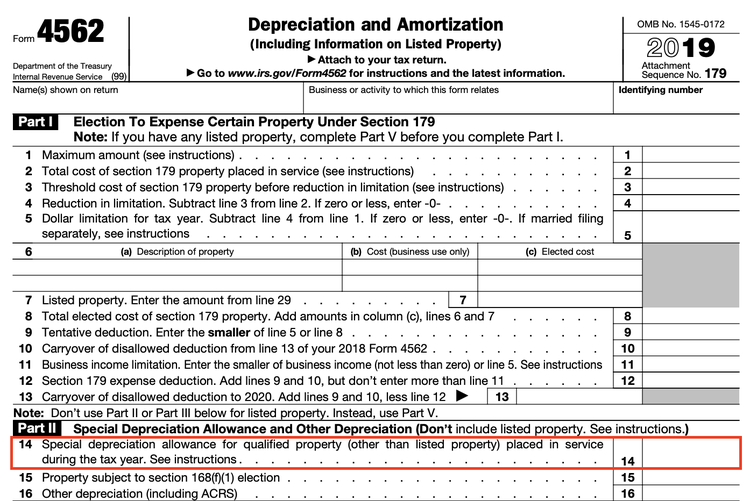

Any depreciation on a corporate income tax return other than Form 1120-S. The length of the house is 70 feet and the width is 50. Amortization of costs that begins during the 2021 tax year.

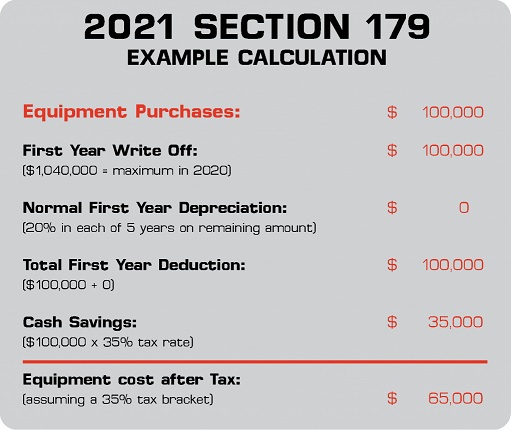

Ordinary un-accelerated depreciation is also called straight-line depreciation because the depreciation expense is the same each year. Note that the IRS requires Section 179 depreciation to be calculated before bonus depreciation. In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of 18200 or 16380.

Depreciation on any vehicle or other listed property regardless of when it was placed in service. Ideally they use a reversed calculation method where a percentage of the salary and CTC is taken. Deferred tax credited to PL etc.

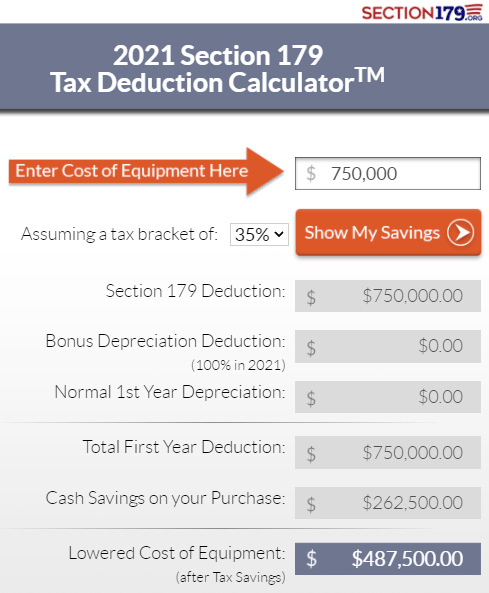

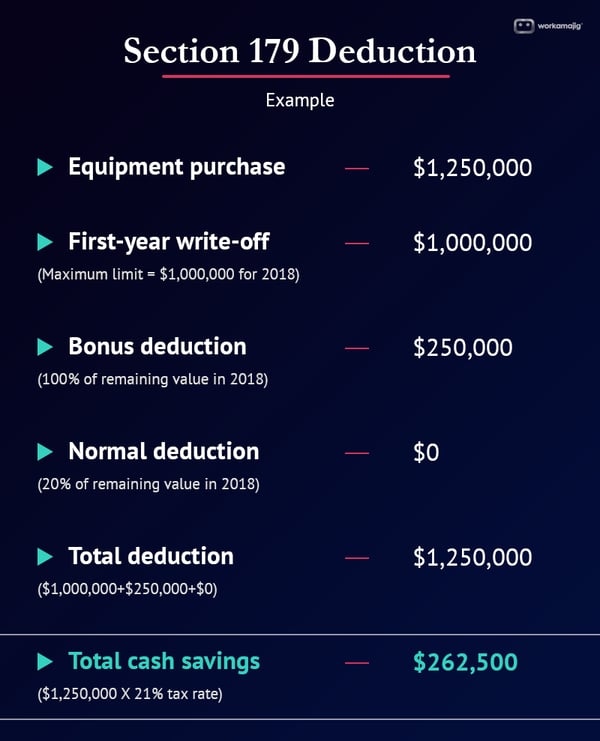

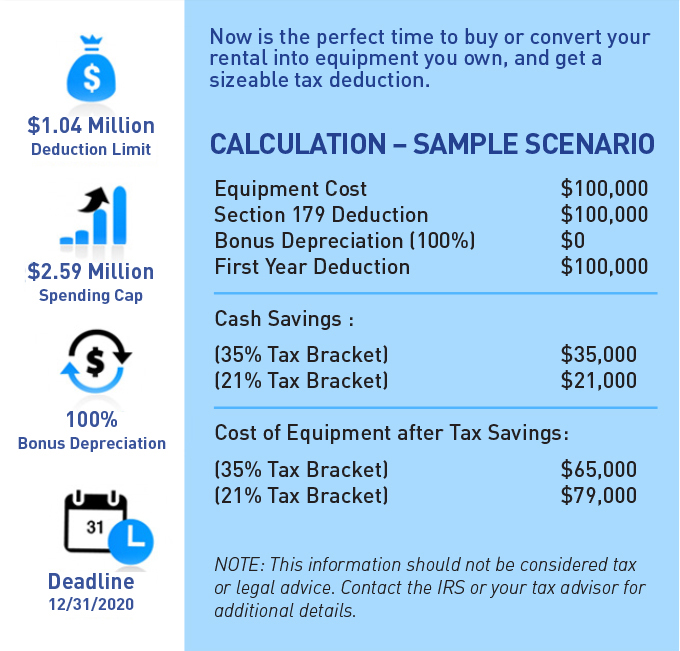

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. The working life is assumed at 3 years. Starting in 2023 the percentage of capital equipment that can be expensed immediately drops 20 per year eg 80 in 2023 and 60 in 2024 until the provision drops to 0 in 202714 Example of a Calculation A generic example can help illustrate how each incentive could be calculated and applied at a business.

Read more of 8000. Let us take one simple example of Depreciation difference in books of accounts and taxable income. But the calculation is more important.

Consult your tax advisor regarding Section 179 and the specific impact on your business. The column Calculation of the indicator indicates the place we are taking the data from. This means to calculate the square footage you will multiply 70 by 50 resulting in a final calculation of 3500 square feet.

If you selects qualified asset 100 bonus depreciation then you should probably select safe harbor rules. For example you cant select 100 bonus depreciation and have a 179 expense deduction too. Salvage value 8000.

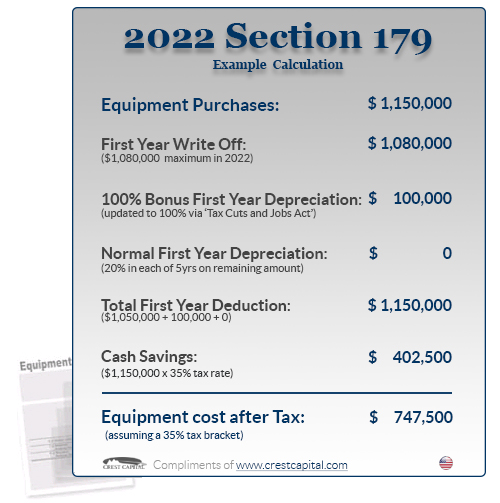

For the PMP exam you must know how to correctly answer questions with formulas about earned value communications procurement probability network diagrams project selection depreciation and some mathematical basics. Example to understand Deferred Tax concept. Maximum allowed Section 179 write-off 1040000 Bonus depreciation for remaining cost 1060000 Total write-off in year one 2100000 Net income has now been reduced by the full purchase price of 2100000.

Here is a list with the types of questions you have to expect. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. Rate of depreciation 5.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. Suppose one company purchases a machine costing Rs. Determine the annual depreciation of the building if the applicable rate of depreciation is 10.

Which Applies GDS or ADS. However there is no definite way to calculate the basic wage as it differs from company to company. A deduction for any vehicle reported on a form other than Schedule C Form 1040 Profit or Loss From Business.

For example pretend you live in a ranch home in the shape of a rectangle. For example if an asset is purchased for 10000 and its useful life is 10 years under straight-line depreciation 1000 would be written off deducted each year. If you use the actual expenses method and the vehicle was acquired new in 2021 the maximum first-year depreciation deduction including bonus depreciation for an auto in 2021 is 18200.

The calculation is illustrated as. Impermissible to permissible method of accounting for depreciation or amortization for disposed depreciable or amortizable property sections 167 168 197 1400I 1400Lb 1400Lc or 1400Nd or former 168 for an item of certain depreciable or amortizable property that has been disposed of by the applicant and for which the applicant did not take into account any. 2 Financing based on credit approval.

Depreciation debited to P. Given Purchase price 100000. There are controversies if deferred tax liability debited to PL should be added to the book income for the purpose of MAT calculation.

300000- on 1 ST April.

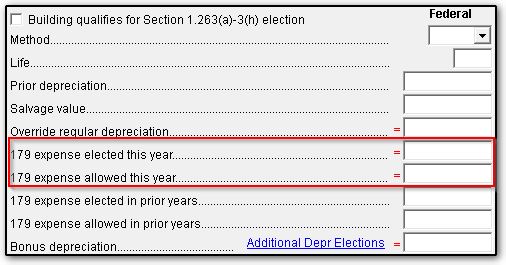

4562 Section 179 Data Entry

The Current State Of The Section 179 Tax Deduction

Calculate Add Back Of Federal Bonus Depreciation For State Reporting Depreciation Guru

Bonus Depreciation Definition Example How Does It Work

Section 179 Deductions For Hvac Equipment Paschal Air Plumbing Electric

2020 Section 179 Commercial Vehicle Tax Deduction

Macrs Depreciation Calculator With Formula Nerd Counter

Section 179 Deduction Hondru Ford Of Manheim

Section 179 Tax Deduction Gt Mid Atlantic

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Section 179 Deduction A Guide For Creative Agencies

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Experience Maximum Tax Savings In 2018 With 100 Bonus Depreciation Shawmut Equipment Crane Sales Rentals Parts Service

Section 179 And Bonus Depreciation In 2013 Blackburn Childers Steagall Cpas

Section 179 Hardware High Touch Technologies

What Is Bonus Depreciation A Small Business Guide

Take Advantage Of The Section 179 Tax Deductions Highway Equipment Company